Procurement

Empower your procurement processes with reliable high quality supplier master data

In today's hyperconnected world, managing vendors is not just about making purchases. It's about building strategic partnerships, ensuring fraud prevention measures, supply chain risk management and driving innovation. To achieve this level of excellence in vendor management, you need a robust foundation of accurate and reliable supplier master data. Explore CDQ supplier onboarding solutions to turn your data into insights and keep your procurement process more efficient.

Impacts of bad master data on procurement processes

One-click supplier creation directly in your daily operation system

Effortlessly tap into existing data from trusted sources, and eliminate the need for manual data creation. Streamline your procurement operations with CDQ solution to seamlessly integrate existing data from trusted sources.

- Intelligent, algorithm based golden record creation is based on 70+ official and commercial reference sources

- 2,500+ ready-to-use data quality rules validate supplier names, legal form, address, business- and tax identifiers in real time

- System overarching duplicate check enables search for matches in own data

- Easy consumption with flexible APIs, ready to use connectors or direct system integration

Empower your team with accurate and consistent information, enabling them to negotiate better deals, identify cost-saving opportunities, and optimize supplier relationships.

See how others do it!

Built on a semantic knowledge graph and more than 2,500 Data Quality Rules, Bayer's data quality framework enables validation with external data and allows an instant-risk-based approval of master data requests instead of 24h service levels.

Optimize risks for improved bottom-line

Doing business with sanctioned or embargo-affected companies can hit the profit and loss statement and cause reputational damage. With CDQ Cloud Services, your data is monitored continuously against the latest sanction and watch lists, and the corresponding monitoring report provides a summary on potential matches. Validation scope can be extended to PEPs (Politically Exposed Persons), too.

Thanks to connectivity to local registers, you can also automate your tax ID verification and make sure that legal address, names and business identifiers are correct (i.e., GST numbers, tax identifiers, national identifiers and other third party and proprietary identifiers) with respect to existence, format, reference format, check digits and consistency.

Top picks for procurement

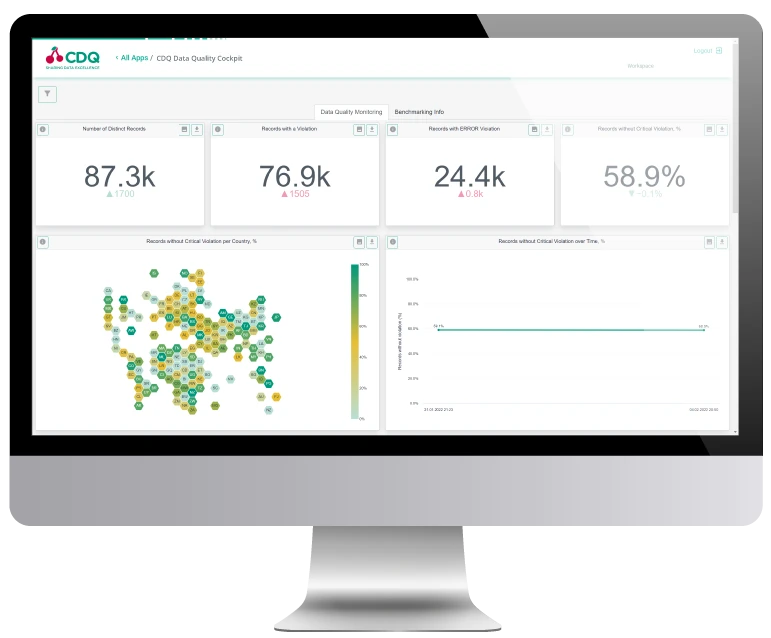

Over 200 million peer-validated records in our CDQ data pool from 70+ trustworthy reference data sources and a set of 2500+ data quality rules, help to define, onboard, and maintain the right data for your vendor relationship. CDQ All Time Right automatically fulfills data entry requirements:

- Check and maintain status of your vendor at entry gate in MDM to enable clean data flows and mitigate supply chain risks

- Tackle all relevant metrics in the supplier onboarding process with central maintenance

- Detect duplicates in own data records to avoid further replication

- Consolidate data from various sources into an augmented golden record

Reduce process costs and mitigate financial and compliance risks for your business with CDQ software solutions. Instead of error-prone manual verification of new or changed bank details, you can automate data maintenance by utilizing the strong sharing network of larger enterprises.

- Accurately detect anomalies at lower cost with early warning system for fraud attacks and reduce financial risk of payments to fraudsters

- Receive in-depth analysis of sanction or watchlist matches and identified politically exposed persons

- Increase validation efficiency with CDQ Trust Score for bank account data

- Reduce process costs and the risk of late payments by ensuring correct and clean bank data

Perform real time qualified checks of your business partners names, addresses, and tax numbers by authority services to reduce risks of financial and reputational damage, ensure seamless audit trail and smooth tax processing. Keep your business tax compliant with no additional manual work.

- Early warnings for non-compliant business relationships

- Identify group risks above the legal level and get updates for group changes

- Base for Credit Limit and Vendor Spend Limit assignment in large groups and franchises

- Avoid fines and losses in reputation with ensured audit readiness

Perform real time qualified checks of your business partners names, addresses, and tax numbers by authority services to reduce risks of financial and reputational damage, ensure seamless audit trail and smooth tax processing. Keep your business tax compliant with no additional manual work.

- Run business partners VAT registration number checks along with associated documentation

- Connectivity to VIES and local registers enables checks via single ready-to-use interface

- Identify compliance or risk issues across business partner data records

- Automate your screening process via API or web app for a one-stop-shop experience

Unlock the value of your supplier master data

- Rule-based quality check at entry point and augmented record creation

- Automatically validated bank data records for accounts payable and receivable process

- CDQ community-based proactive fraud alerts and bank account trust score

- EU VAT qualification of supplier identifiers, legal names and addresses

- 2,500+ ready-to-use data quality rules to validate your data

- Access to data sources like Bureau van Dijk and Dun and Bradstreet

- One-time de-duplication of supplier records across all systems

- Configurable data quality rules for customized validation process