Compliance

Mitigate third party risks with automated screening process and compliance-checked master data

Establish a central view on risk exposure and automate validation and updates for regulatory checks. You can easily implement EU, US, and other country-specific directives for anti-money laundering, counter financing of terrorism or prevention of corruption (PEPs). Our cloud-based solutions quickly identify data records that pose risk to your regulatory compliance.

Impacts of bad master data on compliance

Business partner due diligence: first line of defense to mitigate risks

Introduced in the last few decades, impactful regulations like Anti Money Laundering Directives (AMLD), Office of Foreign Assets Control (OFAC) or The Financial Action Task Force (FATF), to name a few, challenge companies to set up a harmonized view and implement regulatory requirements in MDM. With CDQ services, master data de-duplication, cleansing, standardization, enrichment, matching, and consolidation can be fully aligned with your company’s compliance goals:

- Legal and business linkages of your business partners

- Automatically identified Natural Person data, even in huge data sets

- Sanction and watchlist alerts for non-compliant business relationships (incl. PEP)

- Early warnings for new political or geographic risks in your supply chain

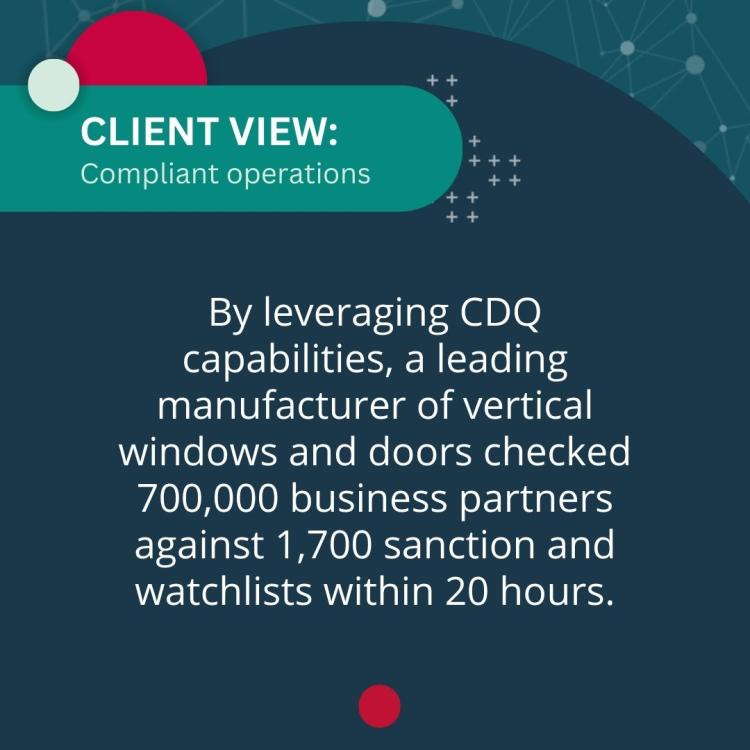

See how others do it!

Thorough due diligence helps organizations avoid engaging with entities that pose financial, reputational, or legal risks. Master data management plays a vital role in this process by providing a centralized platform to manage and monitor partner data, ensuring compliance with regulatory requirements.

Secure your compliance with clean data

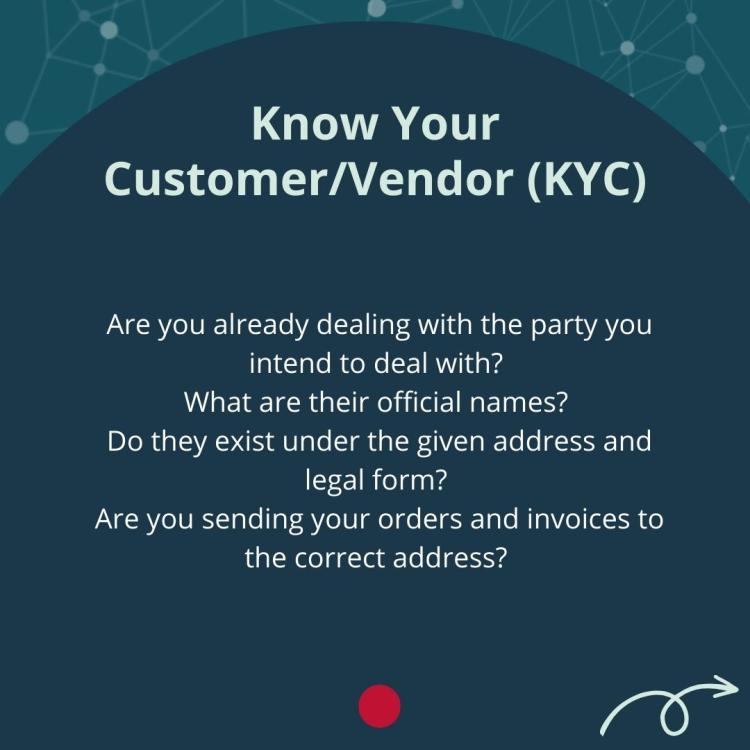

Lean and compliant KYC process

We offer continuous monitoring of business partner data against sanctions and watchlists for you to react promptly and perform required compliance measures in case a positive hit is found. A corresponding monitoring report provides a summary on potential matches and creates a seamless audit trail to prove compliance. Validation scope can be extended to PEPs too.

Ongoing monitoring of counterparties during active business lets you asses risk accurately and with no impact on the daily business. Enabled by clean, accurate and complete data, a 360-degree view of customers supports AML/CFT as well as sanctions, embargos or fraud analysis.

Thanks to connectivity to local registers, you can also automate tax ID verification and ensure correct legal address, names and business identifiers (i.e. GST numbers, tax identifiers, national identifiers and other third party and proprietary identifiers).

Top picks for you

Over 200 million peer-validated records in our CDQ data pool from 70+ trustworthy reference data sources and a set of 2300+ data quality rules, help to define, onboard, and maintain the right data for your business relationship. CDQ All Time Right automatically fulfills data entry requirements:

- Check and maintain compliance status of your business partners at entry gate in MDM to enable clean data flows

- Tackle all compliance relevant metrics in the business partner onboarding process with central maintenance

- Enrich business partners via open and commercial data sources at entry point

- Detect duplicates in own data records to avoid further replication

Thanks to connectivity to local registers and 70+ reference sources, you can easily integrate compliance-checked master data in your corporate due diligence. Our solutions enable continuous and automated business partner data updates, for you to keep ongoing compliance with AML regulations.

- Automatically receive business partner relevant data updates and enrich for compliance screenings

- Immediately identify address changes, new financial status, new owners, legal forms, fraud attempts, bank accounts

- Reduce effort and optimize preliminaries for downstream processes

Perform real time qualified checks of your business partners names, addresses, and tax numbers by authority services to reduce risks of financial and reputational damage, ensure seamless audit trail and smooth tax processing. Keep your business tax compliant with no additional manual work.

- Run business partners VAT registration number checks along with associated documentation

- Connectivity to VIES and local registers enables checks via single ready-to-use interface

- Identify compliance or risk issues across business partner data records

- Automate your screening process via API or web app for a one-stop-shop experience

Reduce process costs and mitigate compliance risks for your business with the innovative approach to fraud prevention. Instead of error-prone manual verification of new or changed bank details, you can automate data maintenance by utilizing the strong sharing network of larger enterprises.

- Accurately detect anomalies at lower cost with early warning system for fraud attacks and reduce financial risk of payments to fraudsters

- Receive in-depth analysis of sanction or watchlist matches and identified politically exposed persons

- Increase validation efficiency with CDQ Trust Score for bank account data

- Reduce process costs and the risk of late payments by ensuring correct and clean bank data

Keep pace with regulatory requirements

- Increased match with legal reference sources thanks to high-quality business partner data

- Rule-based identification of natural persons enhanced by machine-learning algorithms

- Verification of non-registered companies, sole traders, craftsmen etc. enabled by address curation

- Smart detection of sanctioned counterparties with reduced false positives/negatives

- Bank Account Verification as a first line of defense for bank account data (CDQ Trust Score)

- EU VAT qualification of business partners identifiers, legal names and addresses (incl. audit trail)

- Address cleansing and enrichment via 70+ reference sources provided by CDQ

- Access to data sources like Bureau van Dijk and Dun and Bradstreet

- Configurable data quality rules for customized validation process

Discover All Time Right

Blog articles

A practical guide to managing regulatory compliance in business partner relationships

Regulatory compliance is complex and evolving. Not much of a surprise to anyone in today’s global business environment. Governments and international bodies…

Turning compliance challenges into manageable workflows

The world of compliance is a fast-moving, complex landscape, and for many teams, staying ahead of regulations (e.g. AMLD5) feels like an endless game of catch…

Navigating the compliance maze: why real-time monitoring is essential

In today’s interconnected business environment, regulatory compliance is no longer optional. It’s a core component of operational integrity. Organizations must…