Tax ID Verification

Streamline VAT compliance for your business with fast and reliable validation.

Instantly search and validate EU VAT identifiers

The EU Quick Fixes for VAT reform have raised the stakes since January 1, 2020. Recording EU VAT identification numbers is non-negotiable. Failure to comply results in taxes on intra-community supplies.

- Since January 1, 2020, the Quick Fixes for the EU value-added tax reform have introduced strict regulations, making timely compliance a necessity.

- Act promptly! It's now essential for businesses to accurately record all EU VAT identification numbers of customers in their systems.

- Take action to secure your tax exemptions! Invoicing with precise VAT recipient information and submitting accurate EU sales listings are now key requirements.

- Avoid potential issues! Failure to record a valid EU VAT ID for the recipient can result in immediate taxation on intra-community supplies. Protect your business without delay!

CDQ cloud solutions help you ensure compliance, accuracy, and peace of mind.

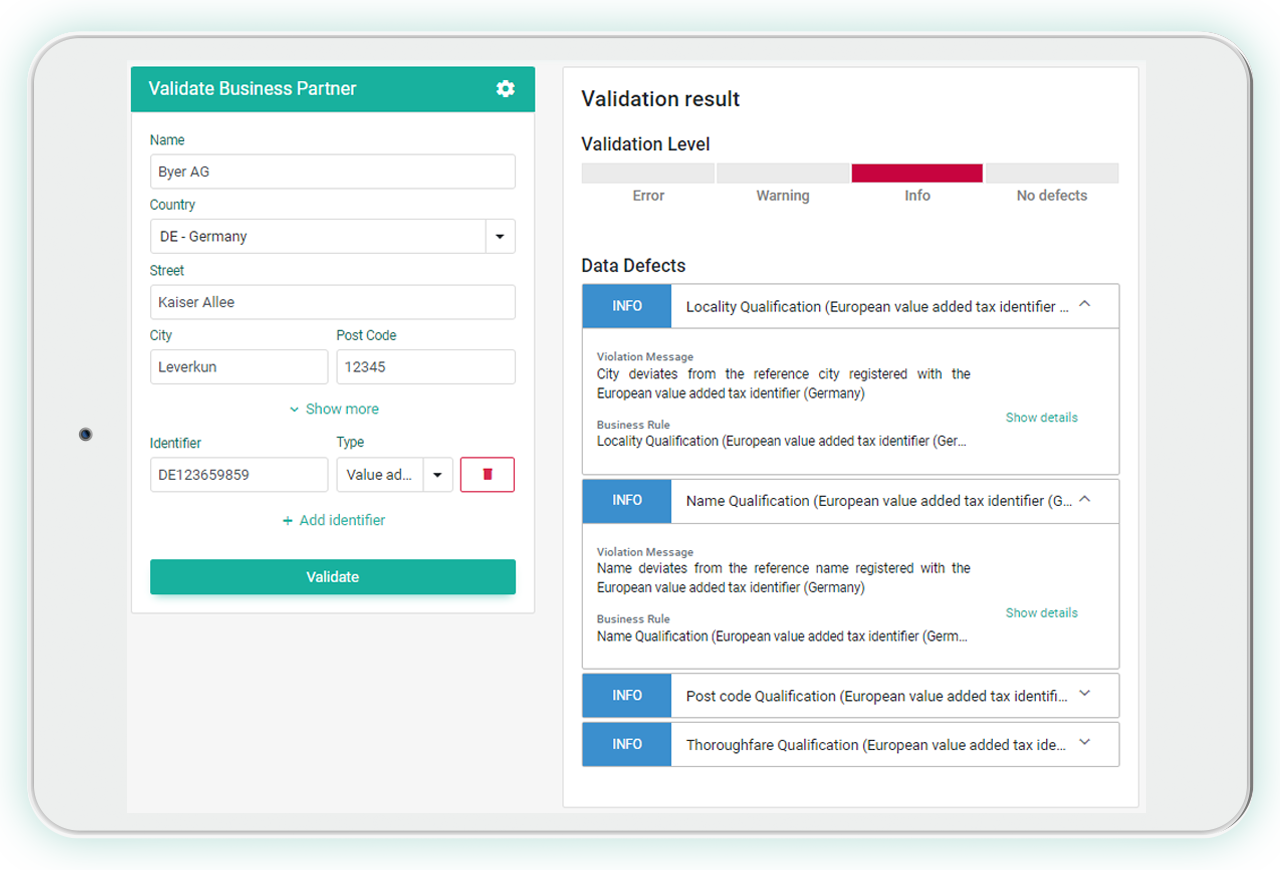

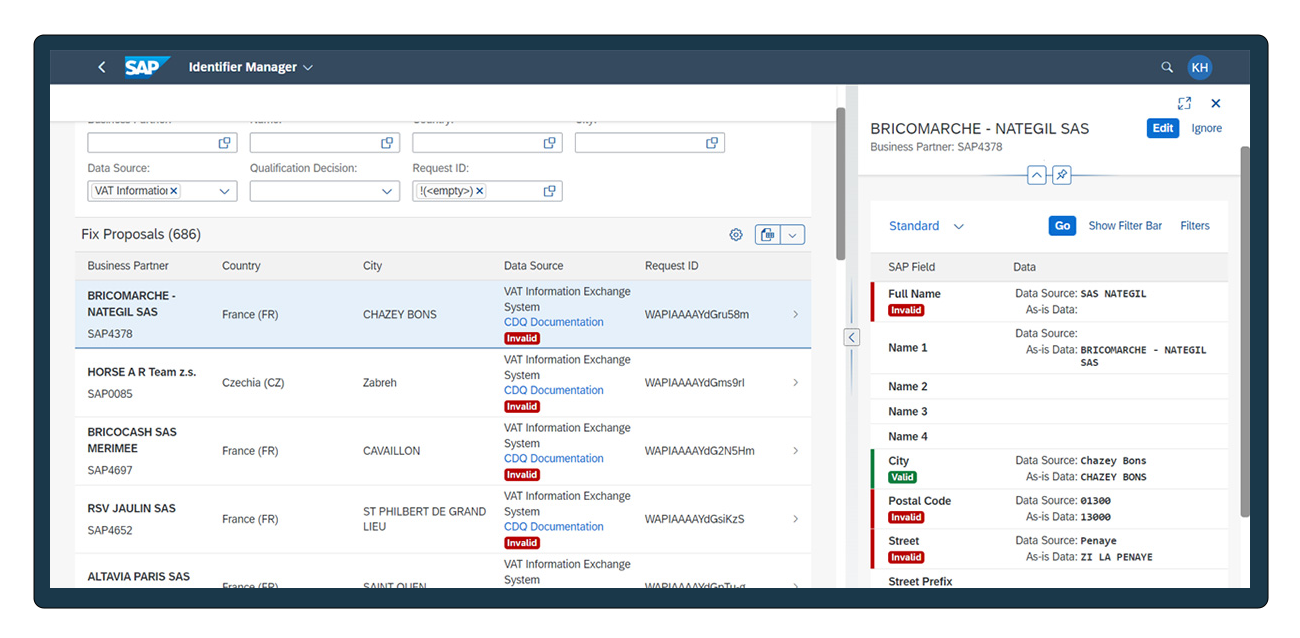

Identify master data inconsistencies to avoid tax risks

Manual verification whether VAT ID is linked to company name or address and actually corresponds to the registered data in respective VAT registration leads to a lot of administrative challenges for companies.

With CDQ, you can avoid problems with tax authorities not just once, but continuously and simplify your tax compliance.

- Compatibility: ready to use in SAP S/4HANA and SAP MDG Cloud.

- Integration: seamlessly onboard and validate records with your existing systems.

- Real-time validation: ensure accuracy and compliance across all EU member states.

- Customization: tailor settings to your specific business needs.

- Audit-proof: EU confirmation code for validated EU tax identifiers.

- Smart monitoring: automated alerts for non-compliant VAT and business identifiers.

- Global reach: optionally validate VAT and tax IDs beyond EU VAT, including the UK and Brazil.

Experience VAT excellence with CDQ

|

|

Commercial providers

|

Other providers

|

CDQ

|

|---|---|---|---|

|

|

Commercial providers

|

Other providers

|

CDQ

|

|

|

Commercial providers

|

Other providers

|

CDQ

|

|

|

Commercial providers

|

Other providers

|

CDQ

|

|

|

Commercial providers

|

Other providers

|

CDQ

|

|

|

Commercial providers

|

Other providers

|

CDQ

|

|

|

Commercial providers

|

Other providers

|

CDQ

|

|

|

Commercial providers

|

Other providers

|

CDQ

|

|

|

Commercial providers

|

Other providers

|

CDQ

|

|

|

Commercial providers

|

Other providers

|

CDQ

|

|

|

Commercial providers

|

Other providers

|

CDQ

|

|

Simple validation of EU VAT identifiers

(format, checkdigit, existence)

|

| | |

|

EU VAT identifier compliance check

(name, address)

|

| | |

|

Real time validation

against trusted authorities

|

| | |

|

Periodical batch validation

against trusted authorities (VIES)

|

| | |

|

Audit proof

EU confirmation code

|

| | |

|

Ready to use

SAP S/4HANA integration

|

| | |

|

API access

|

| | |

|

Search for missing VAT identifiers

|

| | |

|

Automated alerts

for changed VAT registration data

|

| | |

|

Support validation of UK VAT identifiers

with audit proof

|

| | |

|

Support validation of other global business and tax identifiers

(e.g. LEI, CNPJ)

|

| | |

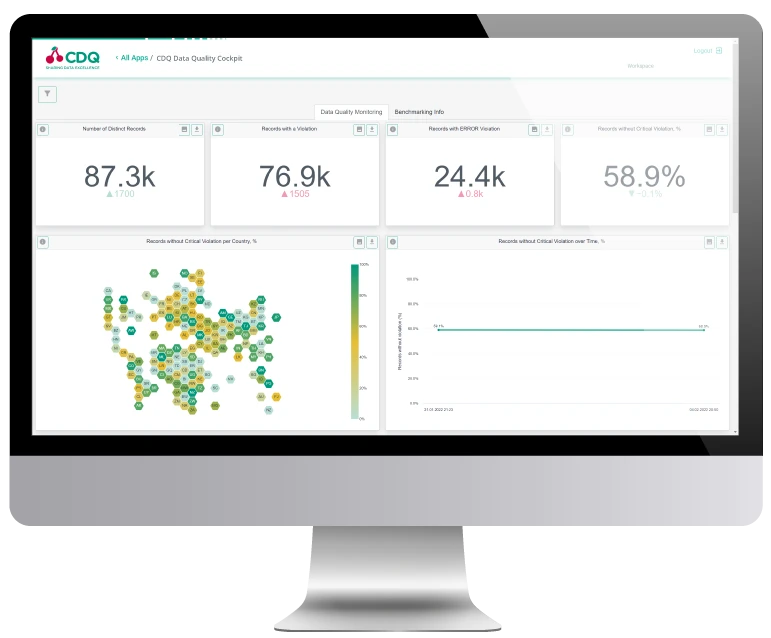

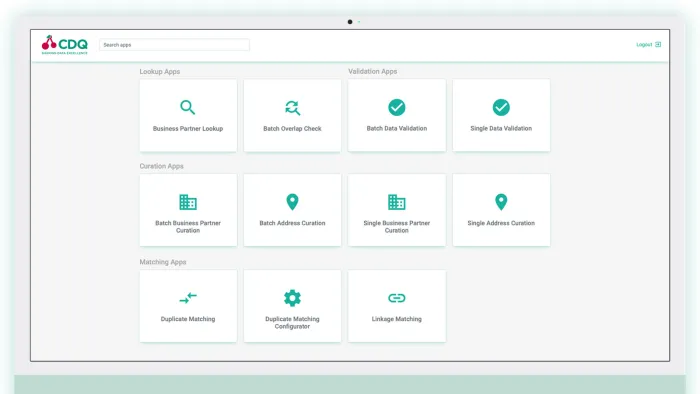

Our capabilities

- Ready to use in S/4 HANA and SAP MDG Cloud

- Cloud based solution allows for integration with existing systems for seamless onboarding and validation

- Real-time validation of EU VAT identifiers of all member states for accuracy and compliance

- Batch processing

- Customizable settings for specific business needs: Direct access to the EU VAT Information Exchange System (VIES) and local tax authorities

- Audit proof: EU confirmation code for all validated EU tax identifiers

- Automated alerts for non-compliant VAT and business identifiers by our smart update monitoring

- Search for ready to use business partners including their valid EU VAT number

- Optionally, global validation of VAT and tax identifiers beyound EU VAT (including validation of VAT and tax IDs in UK and Brazil)

Solutions recommended for you

More trust: Asses data

- Find out how much of your existing data is correct, complete and fit-for-use.

- Rule-based assessment of data quality reveals any duplicates and errors across your business partner datasets.

- Our platform is open to all connected registers – including audit-trail.

More speed: Create data

- Create new business partner data records fully correct and fit-for-use from the start.

- Rule-based validation of onboarded record prompts missing or incomplete information and qualifies tax identifiers against trusted authority services.

- Ready for use in S/4 HANA and SAP MDG Cloud

More efficiency: Maintain data

- Continuously monitor correctness of tax ID and address details of an existing business partner.

- Automated ongoing validation ensures you are always working with the most up-to-date information.

- Any changes of data records are prompted to you in the system and through push messages.

VAT related blog articles

SAP Master Data Integration

With SAP Master Data Governance (MDG) in place, your goal is to ensure that the data is accurate and consistent across the entire organization. Reliable…

Business and Tax Identifiers: Empowering Interoperability and Compliance

With a standard ruleset of >2'100 data quality rules specifically designed for business partner data worldwide, this service is capable of detecting and…

Are you a data quality champion or a data quality chump?

How benchmarking can help you find out! Data quality benchmarking helps to identify gaps in an organization's data quality processes and target their…