CDQ Fraud Prevention

Ready to use fraud detection solution for safe and compliant business operations

CDQ Trust Score and community warnings

Fraudsters continuously develop their methods. Companies can only prevent fraud by staying on top of the game with ongoing improvement of fraud prevention.

Payment fraud with falsified invoices is a serious threat for companies. Instead of error-prone manual verification of new or changed bank details, you can automate data maintenance by utilizing the strong sharing network of larger enterprises. CDQ Trust Score indicates reliability of a given bank account in real-time. In addition, the members of our community alert each other to new fraud attempts and bank data can be monitored accordingly.

Safeguard your company from insecure business partners on full fraud alert

- Out-of-the-box fraud protection via web app or direct system integration

- Prevention of payment defaults with proactive insolvency warnings

- Geographical and political risk alerts for supply chain protection

- Real-time bank account verification

- Master data enrichment to reveal business partner data hierarchy

- Protection from unintentional use of personal identifiable information

- Direct access to continuously updated Fraud Case Database

- Community know-how from the CDQ Fraud Prevention working group

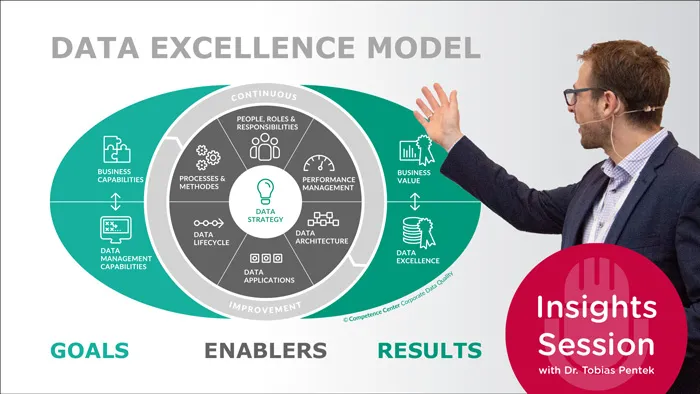

Automated alert flow powered by collaboration

We leverage Data Sharing Community know-how to build an efficient process to prevent fraud. Use automated tools to increase security and:

- design fraud prevention process that best matches your business situation

- validate bank accounts via web app or direct system integration into your workflows

- individually configure trust score calculation to fit your risk threshold

At CDQ we believe we are stronger together: discover how the power of community intelligence can safeguard your business against continuously evolving fraud techniques.

See how ombating fraud challenges with data collaboration works:

CDQ Fraud Prevention key capabilities

Non-compliance of trade embargoes and sanction lists can generate significant costs and reputational damage. Get automated alerts on companies, affiliates, or persons sanctioned or affected by embargoes.

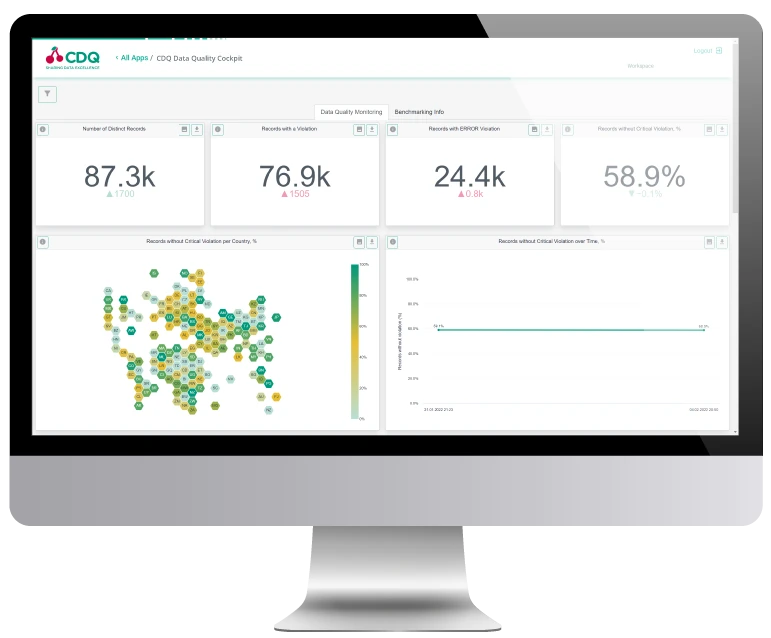

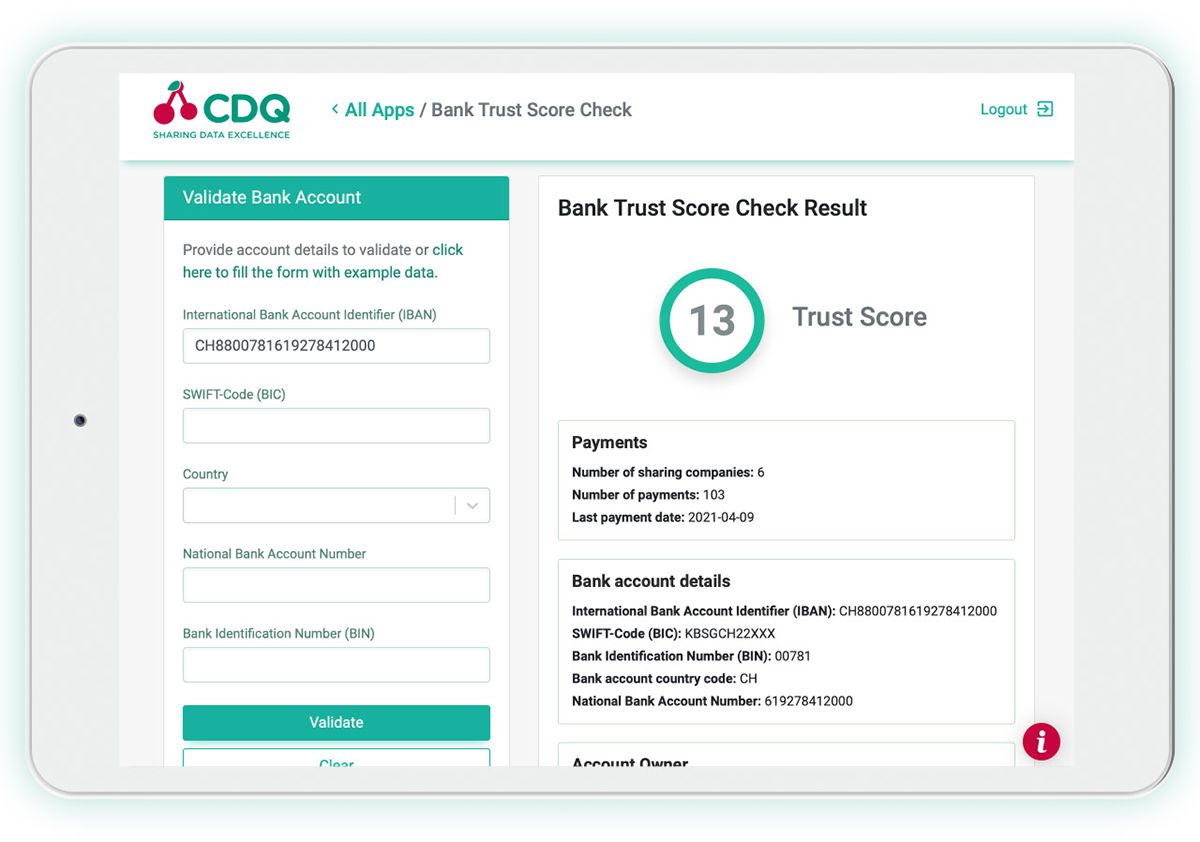

Automate screening for critical accounts and get trusted bank account data with just one click. Instant verification via web app or direct system integration for real-time member companies of our Data Sharing Community.

Stay compliant no matter the number of your business partner records. Easily identify hidden personal data in your business partner master data and generate compliance report quickly.

Natural disasters, environmental events, uprisings, or military conflicts affect the respective region and the global markets and supply chains. Obtain proactive alerts about geographic or political risks protect your company from potentially insecure business partners.

Receive notifications about a business partner’s current or impending insolvency. We proactively inform you about flagged insolvency cases during data maintenance.

Receive alerts when a fraud attempt with fake banking details is detected. The fraud case browser enables companies to share fraud cases internally across all systems.

Latest articles from our blog

Turning compliance challenges into manageable workflows

The world of compliance is a fast-moving, complex landscape, and for many teams, staying ahead of regulations (e.g. AMLD5) feels like an endless game of catch…

Navigating the compliance maze: why real-time monitoring is essential

In today’s interconnected business environment, regulatory compliance is no longer optional. It’s a core component of operational integrity. Organizations must…

CDQ AML Guard: How-to Guide

In the complex landscape of business transactions, enterprises face the critical challenge of screening business partners against sanctions and watchlists while…